This blog is a wakeup call. Inflation is here to stay…without substantial intervention. Intervention isn’t going to happen until those making the calls acknowledge this is not a transitory situation and implement necessary actions to include raising interest rates. However, as you will see outlined below, even that will most likely not tame the monster.

Don’t wait for that admission or those remediating actions. You can see it and feel it yourself right now.

Understanding Inflation: It’s Impacting You Now, and What Can You Do?

Inflation is a tax, and it affects everyone. In the most simplistic terms, if it is running at 10%, you can anticipate 10% of your top line revenue as an increased expense. It won’t be in one line called inflation but will be spread out across your income statement in increased costs for labor, materials, and opex. What does that do to your profitability? Many companies run with less than a 10% profit to start with. You can do your own math on what this will mean to you.

Inflation is a tax, and it affects everyone. In the most simplistic terms, if it is running at 10%, you can anticipate 10% of your top line revenue as an increased expense. It won’t be in one line called inflation but will be spread out across your income statement in increased costs for labor, materials, and opex. What does that do to your profitability? Many companies run with less than a 10% profit to start with. You can do your own math on what this will mean to you.

We will talk more about these opportunities in upcoming blogs on this topic. Read on today for a refresher on this evil called inflation.

What is Inflation?

It has been thirty years since we have had to really worry about the impact of inflation. We all need to brush up on our understanding of what it is, what causes it, the damage it will do, and what we can do about it.

Inflation is the deterioration of purchasing power of a given unit of exchange (i.e., a currency) over time. The Consumer Price Index (CPI) is currently telling us we have clocked 6.1% in inflation over the past 12 months. The rise in the general level of prices relative to the asset of exchange (in our case, the U.S. Dollar), is often expressed as a percentage. When the percentage is moving up and to the right over time, that indicates that a unit of currency effectively buys less than it did in prior periods.

Bottom Line – it is not always the asset price that is moving up in an inflation environment; it can also be that the value of the unit of exchange (in our case the dollar) is moving down. In some cases, both measures could be moving in opposite directions in tandem!

Definitions

Transitory inflation appears periodically or sporadically (such as in specific sectors or various time periods) in the economy and is supposed to be of short duration. This term has been very controversial in the past two years because of the reluctance of the Federal Reserve to label inflation being recorded in the economy as anything other than temporary or “transitory”.

Broad-based inflation is generally regarded as inflation that is recorded in most or all sectors. This appears to be happening now and the Fed’s hesitancy to use this label is very, very intentional. Admitting to this term will force action on their part to fight the boogey-men of all inflationary terms – Hyperinflation (out of control price increases) vs. Stagflation (sluggish growth and unemployment).

What are Some of the Causes of Inflation?

The causes of inflation are numerous and complex. There is significant debate on the causes with two [mainstream] competing theories – Keynesian and Monetarist Economics. You can research and geek out on those theories. They are summarized below.

Keynesian Theory

According to the Keynesian theory, inflation arises when one of two conditions occur: 1) when there’s an increase in production costs or 2), when demand for products and services increases faster than supply.

Monetarism

According to this theory, the fundamental factor underlying inflation has little to do with things like labor, materials costs, or consumer demand as listed above, but, instead, it is driven by the supply of money.

Does it matter which theory you believe in?

Currently, no matter which way you look at the theories, and regardless to which you ascribe, it doesn’t matter – because the cost-push, demand-pull, and too much money circulating factors are all present now in one form or another. It does not take an economist to appreciate that we are experiencing significant inflationary impacts that stem from multiple sources.

This blog is not meant to pinpoint the causes for today’s environment or lay blame. The point to be made is that the publicly-fought battle of whether or not that inflation is transitory or broad-based, is a fool’s errand. Inflation is here. It’s real. If you fail to respond to it with appropriate defensive measures, it could take you out of business.

This blog is not meant to pinpoint the causes for today’s environment or lay blame. The point to be made is that the publicly-fought battle of whether or not that inflation is transitory or broad-based, is a fool’s errand. Inflation is here. It’s real. If you fail to respond to it with appropriate defensive measures, it could take you out of business.

Can Inflation Be Stopped?

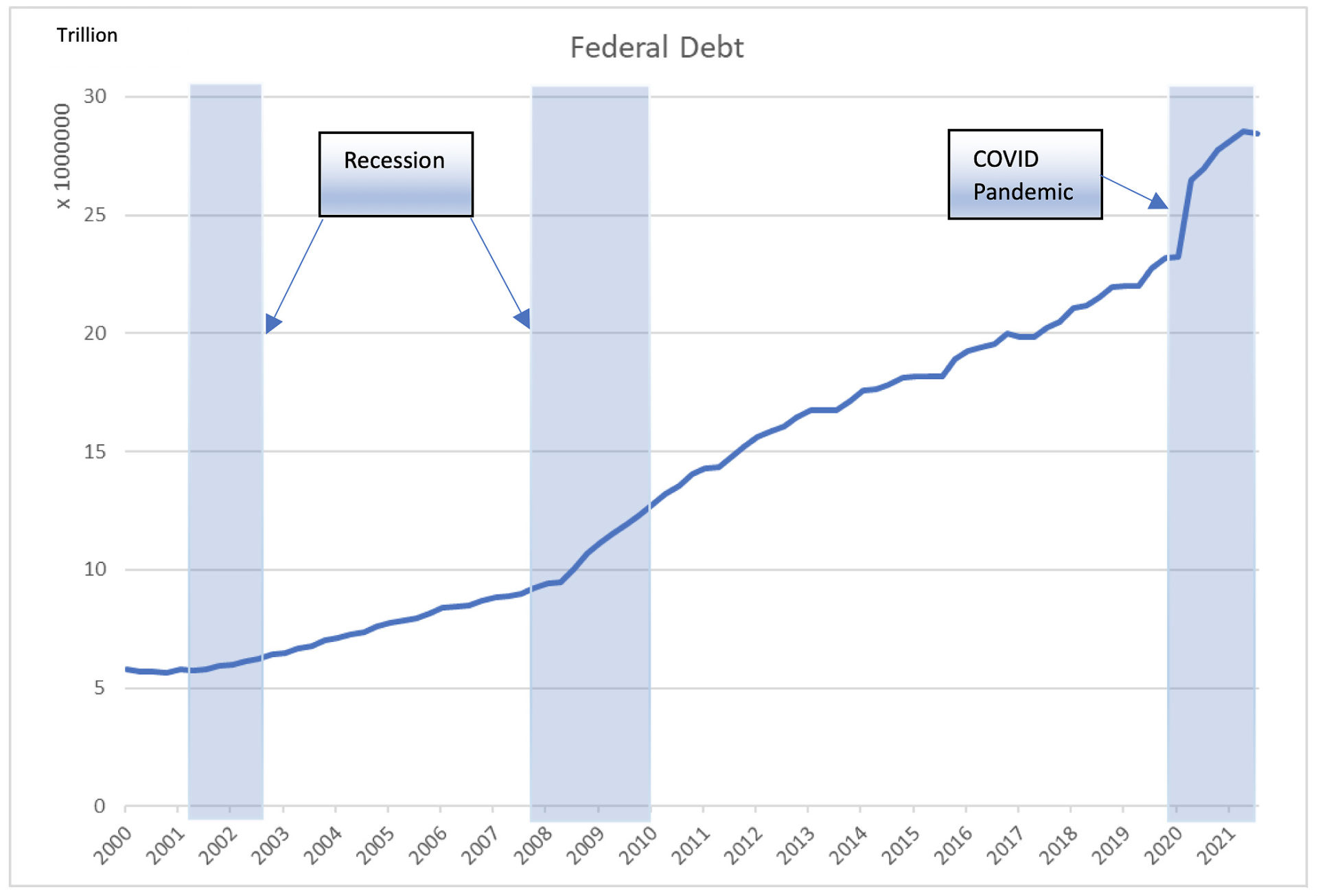

Once the money supply cat is out of the bag, as has happened with our NUMEROUS, massive injections of cash in the past 18 months, it is next to impossible to reel it back in. Historically, the go-to method that the Fed leads with is raising interest rates, making it more expensive to borrow money. Typically, they attempt to feel their way to the right spot with gradual .25 to .5 basis point increases. Ironically, they have never found that sweet spot. The below charts illustrate why it will be very difficult this time to impact inflation with gradual raises in interest rates.

Below is a graph depicting Federal Debt outstanding since 2000:

https://fred.stlouisfed.org/series/GFDEBTN

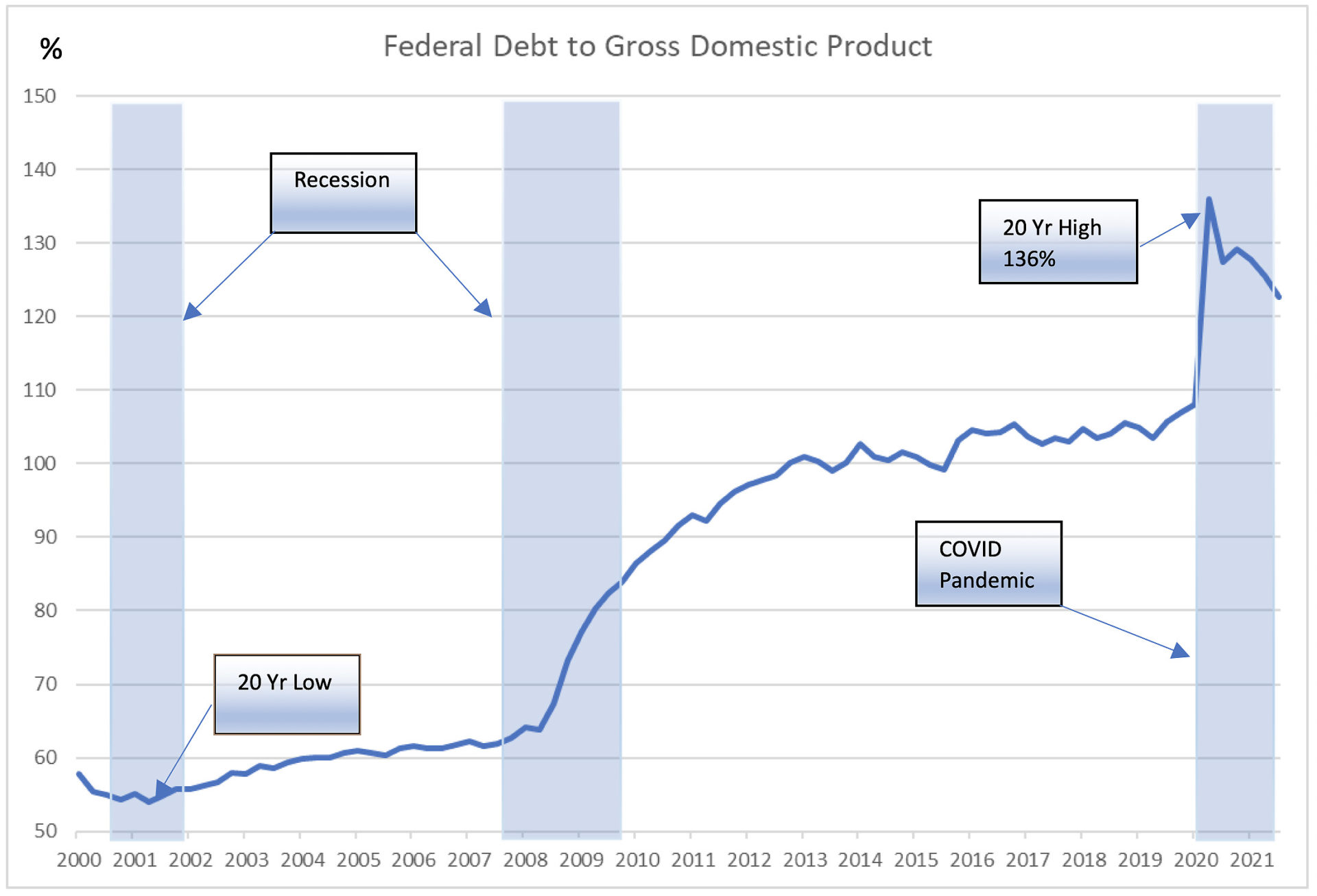

Here is the Federal Debt in relation to GDP:

https://fred.stlouisfed.org/series/GFDEGDQ188S

When the debt load of a country approaches 130% of income (Gross Domestic Product), there is a serious problem. Keep in mind, that the above does not include State, Municipal, Corporate nor Consumer Debt. State and local government debt stands at an additional 3.6 TRILLION. Non-financial corporate debt amounts to roughly 12 TRILLION. https://fred.stlouisfed.org/series/BCNSDODNS

Below is a graph of Non-Financial Institution Corporate Debt in the United States.

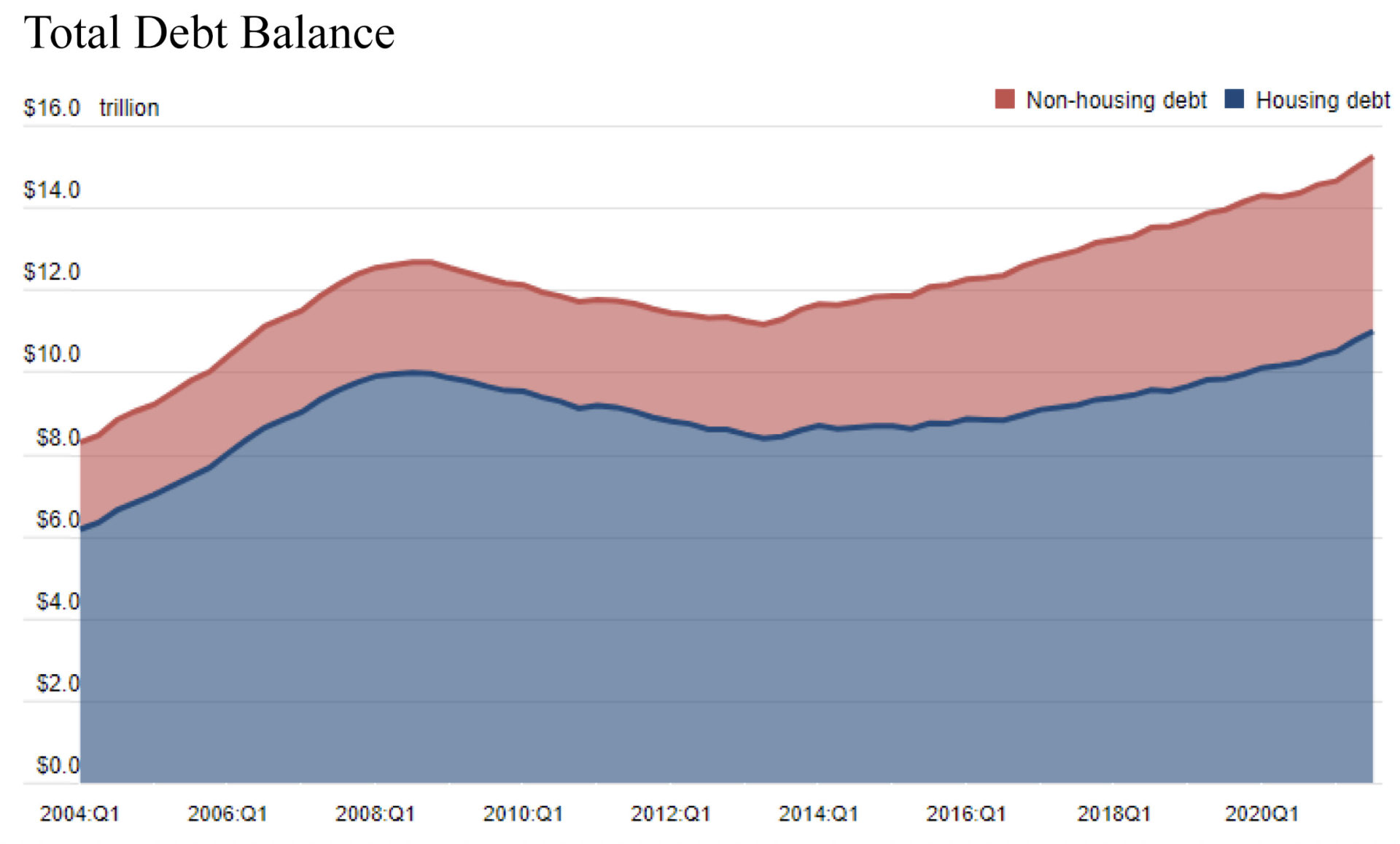

Source: FRBNY Consumer Credit Panel / Equifax

© 2021 Federal Reserve Bank of New York. Content from the New York Fed subject to the Terms of Use at newyorkfed.org.

https://www.newyorkfed.org/microeconomics/hhdc

National, state, and local government debt outstanding is close to $60 trillion. That is a huge number but still does not capture the total U.S. debt that is out there. Pensions and financial institution debt quickly expands the number. Any way you look at it we have had a debt explosion in the past decade. The effect of 1, 2, 3, even 4 interest rate hikes will amount to 1, maybe 1.5%. Further, 1.5% on 60T of debt capital will result in approximately $900B in additional debt service per year somebody has to pay. The somebody paying is going to be us, the US Taxpayers! Fixed rate debt will remain the same, but anything new, and anything that adjusts or needs to be rolled over will pay the price of higher rates. There is simply too much issued debt to manage with interest rate increases. This effectively limits what the Federal Reserve can do.

Why Do Currencies Depreciate?

Currency depreciation also contributes to inflation and can occur for a variety of reasons, such as changes in inflation rates, political instability, and other economic factors.

A “relative devaluation” occurs when the foreign exchange value of one currency drops against the exchange value of other currencies. This is where currencies depreciate/appreciate relative to one another. While this can affect how much to pay for imports and affect prices, it pales in comparison to how productivity affects the absolute currency value.

Productivity and Absolute Currency Value

One of money’s main functions is to exist as a store of value. Employees trade the value of their working labor for a representative amount of assets (as in currency in wages) and they then trade those assets for other goods and services in the market. Productivity is merely the total amount of output (or income) generated in an average hour of work. As an individual employee creates more value through increased productivity, salary should increase in tandem. As a result, employers (or customers) must either pay more units of currency or pay in more valuable units of currency. Theoretically, growth in an economy’s productivity provides the potential for rising living standards over time. However, the CPI effectively tracks the loss of the purchasing power of the consumer dollar (including what they can buy with their labor) and the U.S. dollar dropped another 0.9% in June, the fastest drop since June 1982. Since January 2000, the purchasing power of $1 has dropped to 61 cents. There is nothing “transitory” about that!

What are the Most Current Inflation Trends?

Inflation increased 6.2% from a year ago in October, marking the largest percentage increase in 31 years, as reported by the U.S. Bureau of Labor Statistics on Nov. 19, 2021.

The Producer Price Index (PPI) is a group of indexes that calculates and characterizes the average movement in selling prices from domestic production over time. The PPI is different from the CPI in that it measures costs from the perspective of industries that make the products, whereas the CPI measures prices from the perspective of consumers. The PPI increased in October, as prices for final demand goods rose 1.2% and the index for final demand services moved up 0.2%. The final demand index rose 8.6% for the 12 months ended in October. https://www.bls.gov/charts/producer-price-index/final-demand-12-month-percent-change.htm

Conclusion:

Prices are going up because the value of the dollar is eroding from an oversupply of money in tandem with many, many logistical (and logical) price pressures. This blog is a call to action – you do not need the Federal Reserve to announce inflation is here to stay (they are notoriously late to admit this), nor do you need an economist to tell you and debate the nuances of which sector is moving and by how much. A long-term inflationary environment is here, and it is happening to each of us now. The next couple of blog entries in this series will be focused what you can do to proactively manage through an inflationary environment. Meanwhile, we offer a couple of things to be looking at immediately below.

Take actions now to protect your company:

- Negotiate longer term committed pricing on supplies.

- Pay intense attention to your employees and make fair adjustment proactively to mitigate turnover which is much more expensive.

- Consider your pricing and adjust rates now and regularly to match market actions.

If you don’t know where to start on this or want a second opinion, call us at vcfo, or click here to request a consultation, and let one of our experienced CFO team members walk you through this. Every month you delay making necessary corrections is a month you will bear all the financial consequences of inaction. Retroactive contract concessions and revised customer pricing are not options – so do it now to optimize your chances to navigate this inflationary period successfully.

———

vcfo is a professional services firm making companies stronger by bringing the wisdom and experience of senior level Finance, HR, and Recruiting executives to each client engagement. Our team of consultants guides CEOs and business owners in making strategic decisions, optimizing operations, and providing people support. Partner with the vcfo team to support you in a wide variety of areas, including mentoring and coaching. We have had the privilege of partnering with a lot of great teams in our 25 years and 5000 clients.

Since 1996, vcfo has supported more than 5000 clients nationwide with offices in Austin, Dallas, Denver, and Houston.