Funding for your business can originate from a number of different sources, including family and friends to banks and institutional capital, so it serves business owners well to understand the advantages and disadvantages that accompanies each of these funding options prior to deciding which to pursue.

It is common for business owners and leaders to immediately want to dive headfirst into the different options. However, it is important to first understand the stages of company growth and expansion to determine the appropriate funding source in relation to your current or anticipated growth stage.

The Stages of a Company

Although every growing company moves through common milestones, the length at which a company will spend at each stage is unique. Below are five primary stages that mark a company’s trajectory:

- Start or ‘Idea’ Stage – Initial period where the business first starts to get off the ground.

- Early Stage – Company typically has a commercialized product or service offering and early revenue but it likely not yet turning a profit.

- Mid Stage – Company achieves real growth, has meaningful revenue, reaches profitability, and/or develops significant hard assets (e.g. receivables, inventory, and fixed assets).

- Later Stage – Company has achieved sustained profitability and growth.

- Much Later Stage – Now a fully matured business.

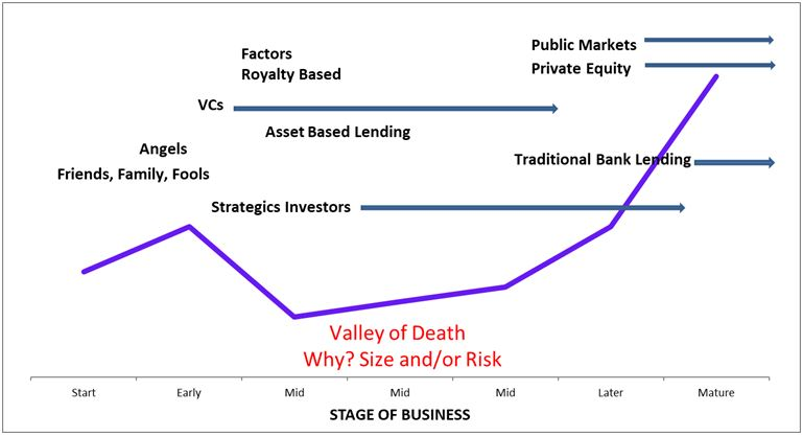

Below is a chart indicating typical funding options for various stages of business, helping you map where your business currently stands in relation to funding. Note: the purple line represents the relative chance of funding success.

Potential Financing Sources (and their Pros and Cons)

Friends, Family and Familiars – Young companies often rely on trusted relationships between founders and their community. As many new businesses are not mature enough for other sources of financing, investments from relatives or friends help entrepreneurs get their ideas off the ground.

Angel Investors – Angel Investors often fund small, green businesses or startups. Angels are individuals, usually business professionals, looking for higher rates of return. When utilizing Angel Investors, you tend to give up less control than you would with a Venture Capital (VC) firm. As with friends and family, you’ll work with smaller individual investments, which can make it more challenging to pull together a meaningful amount of money. While you may benefit from the involvement and advice of an accomplished professional Angel Investor, you can’t expect them to follow on or be available when larger sums are required as you mature. They tend to be taken out or become totally passive until there is a larger liquidity or funding event.

Venture Capital (VC) – VCs look for high growth potential in small to medium sized businesses, typically a scalable technology-related business in a market they see as exceeding $500 million in annual revenue. Most businesses are not candidates for venture capital. Even if you are, there is no guarantee you will get funded by a VC. It’s also important to note that a business owner will potentially relinquish a great deal of control to a VC. However, if you are a candidate for VC funding, it can be a strong source for meaningful amounts of capital that will ultimately help push your business forward.

Factors – A factor effectively buys a company’s receivables at a discount as sales are made. A company must have clean receivables and strong gross margins for factoring to work. This is expensive money and can be viewed as a form of debt for companies that are desperate. Although, more recently with the low interest rates, even factoring can look attractive at certain times. Companies who succeed will graduate to Asset-Based Lending (ABL) and/or traditional bank financing. It is common to see factoring in a small company selling a high margin product or service into larger companies who pay but pay slowly.

Royalty Based – Another expensive form of financing, royalty based involves the financing source making an advance, similar to the initial funding of a term loan. The source is repaid out of a percentage of revenue, effectively a royalty garnered over a pre-determined period of time. The company must also have strong gross margins for royalty-based financing to work.

Asset-Based Lending (ABL) – A step between factoring and traditional bank lending that is priced in between. ABL lenders advance against receivables – typically weekly – and the company directs its customer payments into a lock box controlled by the lender. The idea is that at any point in time, the lender can be made whole simply by collecting money that rolls into the lock box. This requires strong systems and good receivables and can be administratively burdensome. Equipment financing also falls under ABL, typically in the form of loans or leases, and some banks have designated ABL departments.

Traditional Bank Lending – Traditional bank financing is the lowest risk to the lender and is the least expensive for the borrower – if you qualify. For a business to qualify, they need to have two or more of the following: profitability, positive cash flow, assets or a strong guarantor. This type of financing can be in the form of term loan(s) secured by real estate or equipment, or it can be a line of credit secured by accounts receivable and/or inventory. Banks usually require owner guarantees of a closely held business and the business to maintain financial covenants. Two government guarantee programs with bank lending: Small Business Administration (SBA) – where the government partially guarantees small business term loans – and Export-Import Bank (EXIM) – where the government guarantees foreign accounts receivable for US exports. These programs can sometimes support a credit the bank would otherwise have a hard time doing alone.

Private Equity – Once a company has matured and proven itself as profitable, sustainable and on a growth path, Private Equity (PE) becomes a possible source. This can be in the form of equity or subordinated debt with equity kickers. The classic PE play to is buy or invest in a company, leverage with as much bank debt as possible, grow organically and through bolt-on acquisitions and sell at a higher revenue level and a higher multiple. As a close cousin to VCs, the business seeking to fund gives up a lot of control.

Strategic Investors – A strategic investor is a larger company with an interest in your product or service beyond purely “financial” and may want to acquire your company some day or conduct a deal where they incorporate your product or service into theirs. Sometimes Strategic Investors are less sensitive to valuation than a VC but can be more bureaucratic to work with over time. They also often invest alongside venture capitalists.

Public Markets – The final stage (but an entry into the wider world of sourcing) is the public market. Usually, for later stage companies, this is a less expensive option than VC or PE money with a significant cost in reporting and compliance. Many entrepreneurs dream of taking their company through an “IPO” or Initial Public Offering. An IPO is a large expensive undertaking, and SEC reporting and compliance after the IPO can be challenging.

Vendor and Customer Financing – Not on the chart, Vendor and Customer financing are often overlooked and can come into play all along the spectrum. I once had a client that was cash-starved, but its contract manufacturer was cash-rich, and badly needed sales volume. A deal was worked whereby the vendor, aka the contract manufacturer, gave very favorable payment terms in exchange for a higher price – a win-win for both companies.

Surviving a Dip in Funding

A funding drought for a company can occur when it has reached a place where it needs a larger amount capital than it can get from friends, family, and angels; it is not a candidate for or has been unable to get VC financing; it is not mature enough for private equity; or it is not low risk enough for the banks. Factoring, ABL, and Revenue-Based Financing are all niche products that may or may not fit.

This in-between state of funding can be a natural part of any business and making the proper assessments based on your business strength or weaknesses in relation to financing sources can help counter a lapse in funding. Restructuring your business strategy in line with an honest assessment of your financing options may be necessary, but ultimately you’re supporting funding opportunities that will move your business forward and continue building the traction you’ve already successfully built.

—

Need help evaluating the right funding sources for your business? Contact Us and receive a complimentary consultation from a vcfo expert who can get your company set up with the ideal funding strategy for your needs.