THIS IS A BIG DEAL!

DON’T LEAVE MONEY ON THE TABLE

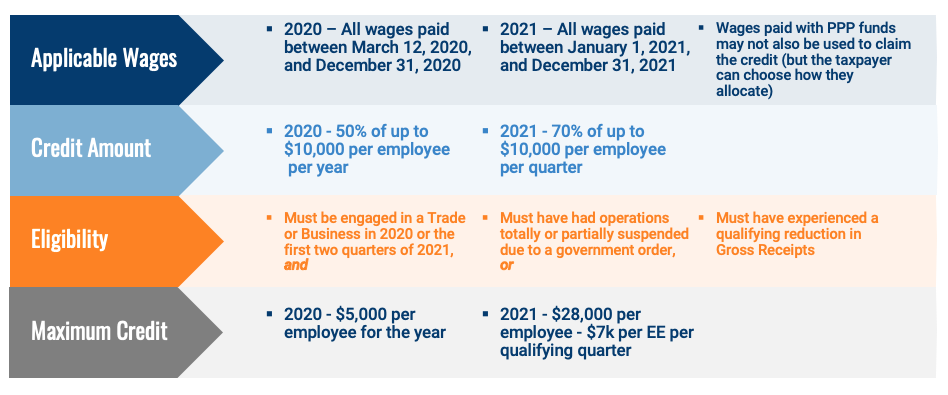

Enacted as part of the CARES Act in March of 2020, the Employee Retention Credit provides a tax credit to employers who qualify based on wages paid. In many cases the credit is substantial.

CLAIM CREDIT EVEN IF YOU RECEIVED A PPP LOAN

Available to all employers who were adversely impacted by the pandemic. Taxpayers can now claim the credit even if they received a PPP loan. Slightly different rules apply to 2020 and 2021 credits.

MAXIMIZE YOUR RETURN: REVIEW ERC BEFORE YOU APPLY FOR PPP 2.0 LOAN FORGIVENESS

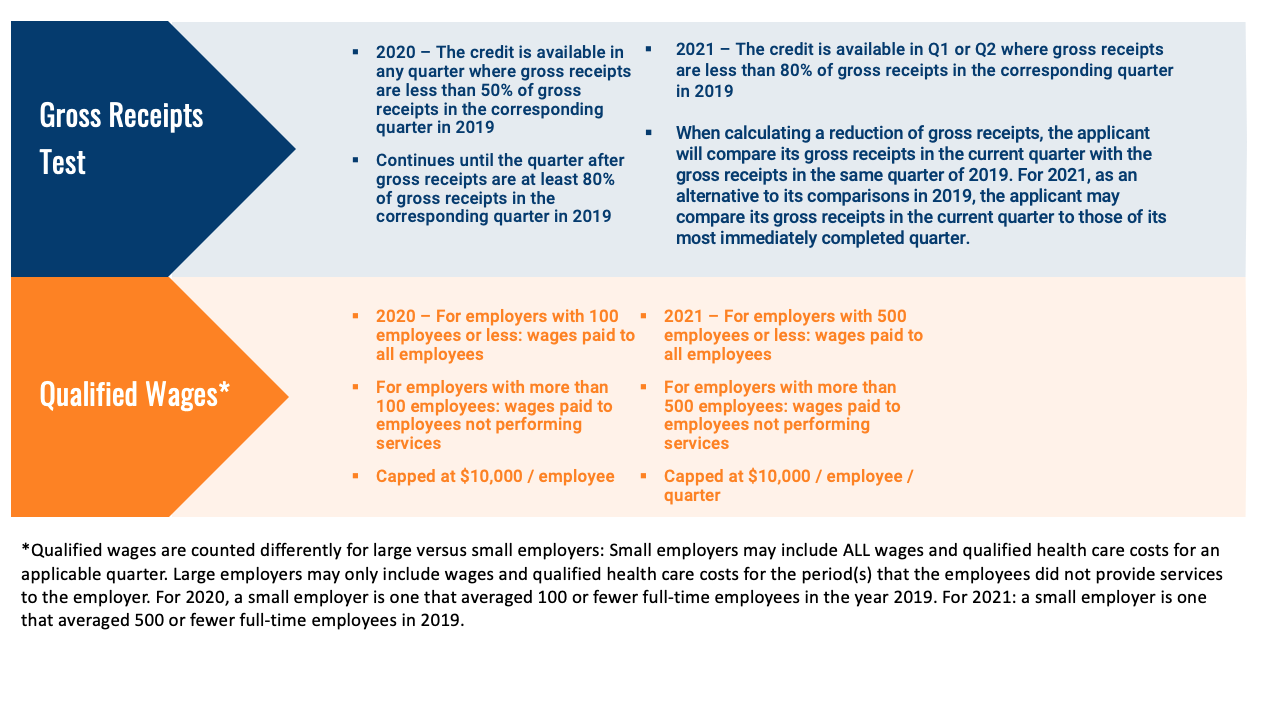

Any wages paid for with PPP funds cannot also be used to claim the credit, nor can wages which are claimed for the FFCRA credit. By reviewing credit eligibility prior to applying for PPP 2.0 forgiveness, companies can maximize ERC potential and still receive full PPP forgiveness.

Wages used to support PPP forgiveness or used to sustain an FFCRA credit cannot be used to sustain an ERC. By reviewing ERC credit eligibility prior to applying for forgiveness, companies can time their submission for PPP forgiveness such that they maximize ERC potential and still receive full forgiveness.

Request a free consultation