Enterprise Sustainability – Cash and Context

The COVID pandemic impact hit hard and fast. Before the government could roll out supportive mechanisms in response to the pandemic, many businesses simply ran out of cash along with options that could have kept their doors open. No one could have fully foreseen COVID-19’s economic impacts, but many business leaders would admit that they could have been much better prepared. While it’s common for individuals to follow a simple practice of having six months or more of emergency funds available, businesses ironically don’t always follow a similar practice or receive similar advice.

A major contributor to this thinking is the tendency to become laser-focused on year-over-year growth. Investing in sales and marketing, manufacturing facilities, and the infrastructure needed to scale, often to attract higher valuations from potential investors as a primary goal. That’s not to say that investing in any or all of these areas is inherently bad. Problems and risks do arise when these and other areas are addressed at the expense of enterprise sustainability. Building for growth or toward an exit is a reasonable business strategy and the charter of many CEOs. If balance sheet insufficiencies, specifically too little cash to weather an unexpected event, wipe a company out prior to sale, all that work and investment washes away completely.

At all times, leadership should understand their company’s level of enterprise sustainability. Put simply, enterprise sustainability is a view of what systemic shocks and crises a company could survive (and for how long) given the mix of resources and array of options available to them at any given time. Let’s look deeper.

What Can We Weather?

Two months into the pandemic, an owner of three restaurants for more than twenty years communicated to his employees that he would be able to continue paying them in full for fourteen weeks, despite looming closures. This was a remarkable and generous feat given the low-margin nature of the restaurant business and the drastic loss of incoming revenue. The owner shared that the business had been preparing for this for a long time, anticipating that a sizeable crisis of some sort was bound to happen sooner or later. He knew that absorbing such a shock would require cash, and more broadly speaking, liquidity. Business leaders need to ask the same question in their companies – what are we prepared to weather, and for how long?

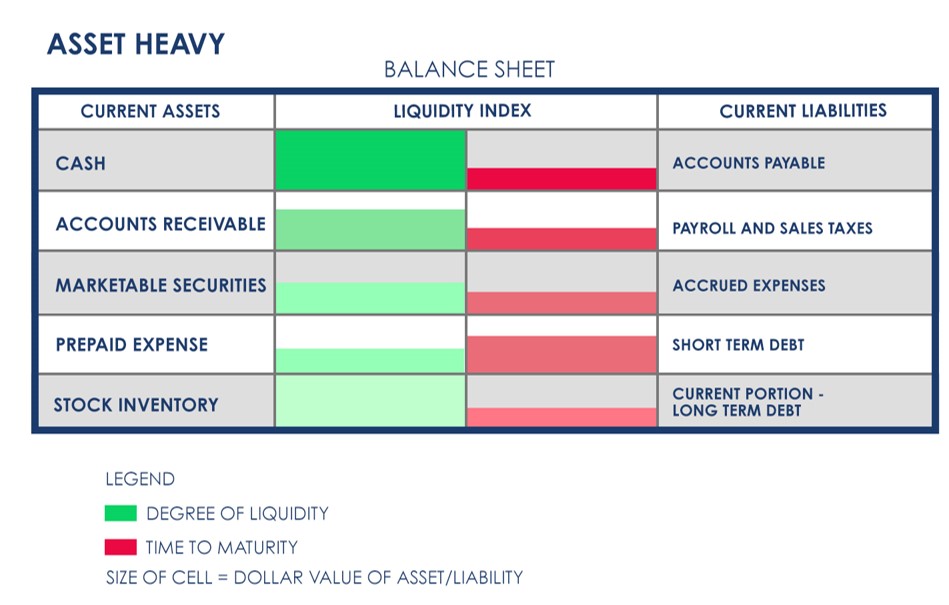

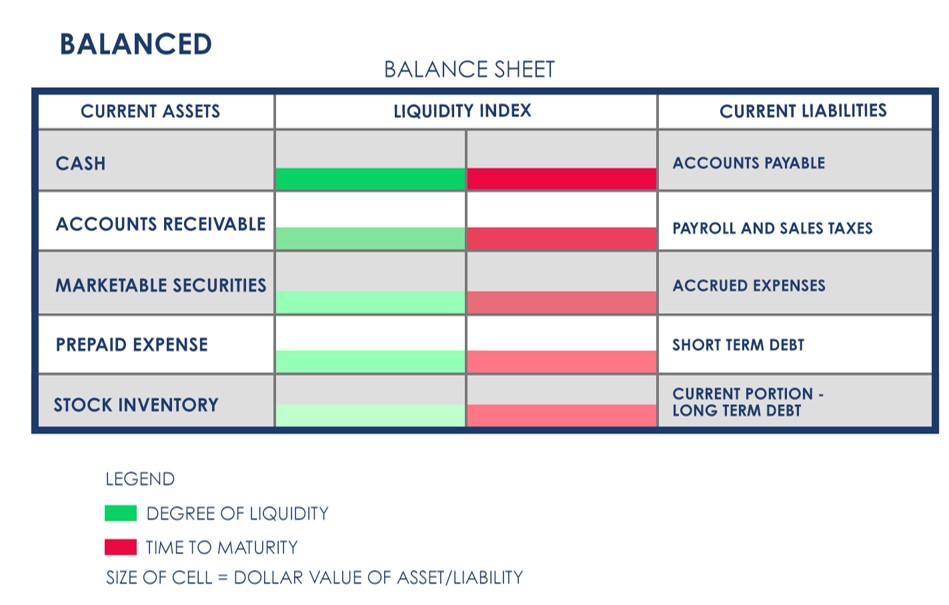

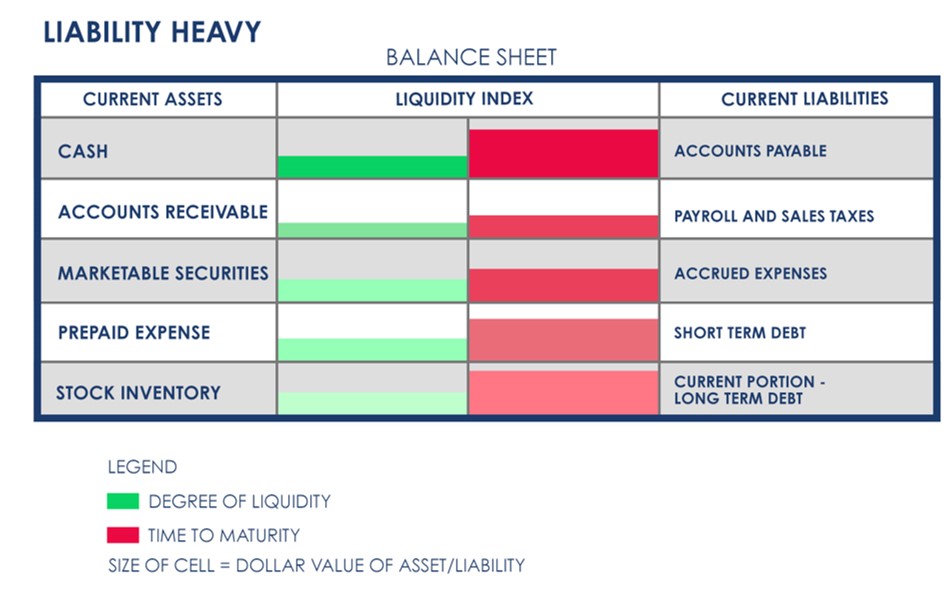

Years of work with CEOs have shown that most place a great deal of focus on the Income Statement to understand levels of profitability. However, the balance sheet is the fulcrum that determines liquidity. Specifically, the balance sheet provides a picture of assets (cash, accounts receivable, marketable securities, prepaid expense, and inventory) and liabilities (current liabilities, payroll and sales taxes, accrued expenses, short-term debt, the current portion of long-term debt). The focus needs to be on the relationship between cash and close equivalents and current obligations. This view of the balance sheet liquidity helps to illustrate enterprise sustainability and the options available for extending it.

For example, an asset-heavy organization – where assets greatly outweigh liabilities – has a more attractive array of options and a generally higher degree of enterprise sustainability. However, the mix and types of assets are very important. For example, a cash asset is obviously more liquid than marketable securities, which need to be sold to turn them into hard assets. Until those investments are liquidated, marketable securities only hold intrinsic value. Prepaid expenses reduce required future cash outflow, and so are not as liquid as cash and stock inventory. Stock inventory – inventory that is expected to be sold over the coming year – could, if needed, be sold at losses to generate emergency cash. High levels of accounts receivables may signal that the organization needs to enhance its collection efforts to convert it to cash more quickly. A company heavy in fixed assets, such as property and equipment, does not have the same flexibility because those assets cannot help pay bills in an emergency. These examples illustrate the importance of understanding the elements of your assets and what you can do with them in an emergency.

Conversely, an organization that is very heavy on the liabilities side usually has more challenges from an enterprise sustainability standpoint. However, that’s not to say there aren’t options available here as well with deeper analysis. For example, what is the mix of short-term versus long-term debt? How far into the 12-month cycle are the respective areas of short-term debt? In many cases, there are opportunities to renegotiate terms on long-term debt to move repayment further out and create more breathing room in the event of a crisis.

Context, Confidence, Control

Most organizations find themselves somewhere between heavy on assets and heavy on liabilities. The main point here is that understanding where an organization sits from a balance sheet liquidity, and more broadly, an enterprise sustainability standpoint is critical. Knowing this will guide informed actions to improve enterprise sustainability and to redefine the parameters, including the need to protect sustainability, used to make future investments and other similar actions. To further complicate and inform actions toward sustainability, it is important to consider the context of current and forthcoming market conditions and how those impact decisions.

Sleeping Better

Conducting an exercise to evaluate your business economic sustainability is rewarding in many ways. You can develop a plan to move toward sustainability if you are operating too close to the edge. There are a lot of dials to turn to optimize things while you are not in a crisis. If you find yourself sustainable without having planned to be, congratulations! You can tighten up your internal processes and guidelines to ensure you remain focused on sustainability during future decisions and maintain the reserve you need. You may also find you are sitting on more reserves than you need and free up capital intentionally for expansion. Either way you will be more informed and operating from a position of strength when unanticipated events, most recently the pandemic, threaten to knock you off your game. Most importantly, you will know where you stand and what you need to do, and that leads to a better night’s sleep.

———

If you are like most CEOs, your primary focus is revenue and profitability. After all, without that, there is no business. Would it help you to have some assistance walking through your elements of your balance sheet and gaining a better understanding of liquidity and economic sustainability? Request a free consultation today from a vcfo expert who can help.

You may also find these related posts helpful and informative:

- Updating Accounting and Finance Practices for Growth

- How To Fight Inflation: 14 Tips For Business Owners

- Budget Methodologies: Analyzing the Advantages & Disadvantages